Disclaimers and Disclosures

- “The Value of Financial Planning.” Financial Planning for Canadians, Financial Planning Standards Council, 25 June 2020, www.financialplanningforcanadians.ca/financial-planning/benefits-of-financial-planning.

The Certified Financial Planner® (CFP) certification is the most widely recognized financial planning designation in Canada and worldwide. This certification assures Canadians that their financial future is trusted to professionals committed to prioritizing their clients’ interests over their own. CFP professionals showcase a comprehensive blend of expertise, experience, ethical standards, and skills required to analyze the intricate financial landscape of their clients to build a comprehensive financial plan with the highest professional standards. To maintain their certification, CFP professionals continuously update their knowledge and skills by undertaking 25 hours of continuing education each year.

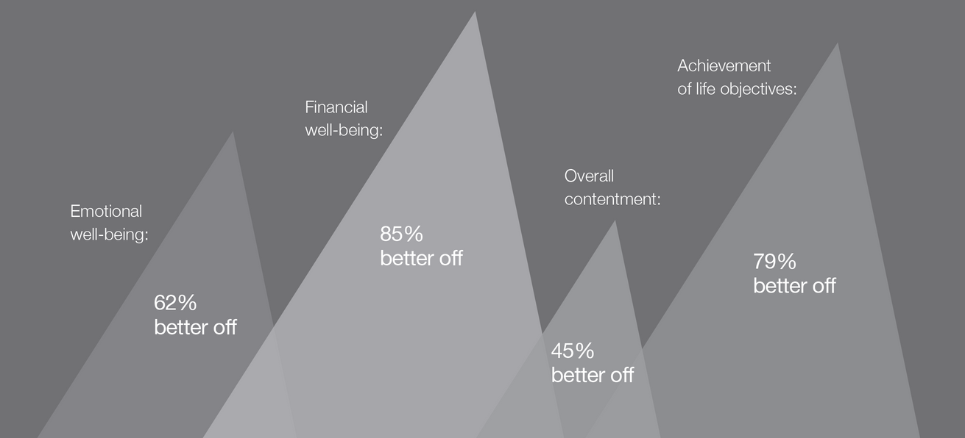

According to a three-year longitudinal study, The Value of Financial Planning1,commissioned by FP Canada in conjunction with the FP Canada Research Foundation, regardless of net worth, Canadians who engage in comprehensive financial planning with a CFP professional confirm significantly higher levels of financial and emotional well-being compared to those who engaged in limited or no planning.

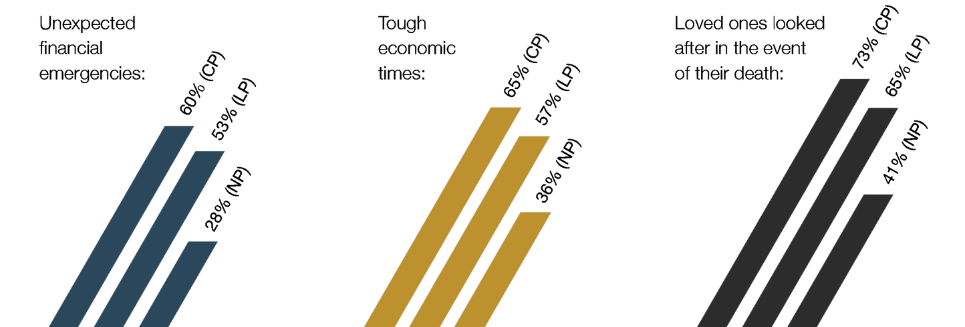

Those who have comprehensive financial plans are more confident that they are prepared to deal with the challenges and bumps in life, such as unexpected financial emergencies, tough economic times, and ensuring loved ones are financially looked after if something should happen to them.

Prepared to deal with:

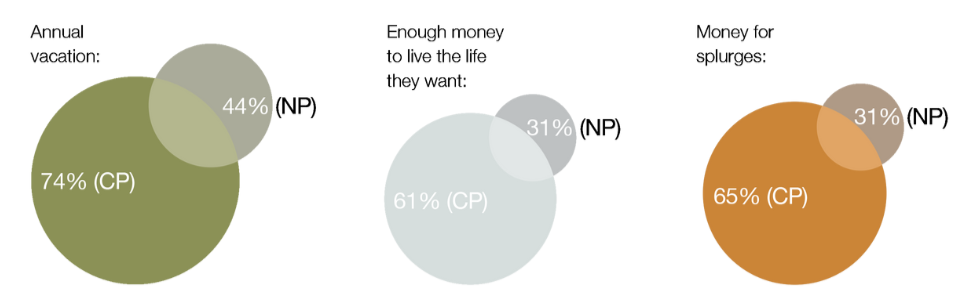

Those who do engage in comprehensive financial planning also feel more confident in reaching the discretionary goals they identified as important.

CP = Comprehensive Planning, LP = Limited Planning, NP = No Planning

Most people think all financial planners are “certified,” but this isn’t true. Just about anyone can use the title “financial planner.” A CFP professional must acquire several years of experience related to delivering financial planning services to clients and pass the comprehensive CFP Certification Exam before they can call themselves a CFP professional, after having have met the rigorous qualifications for financial planning.

CFP professionals are required to fulfill the following three duties: