Blending tradition and innovation: Building a balanced portfolio for today’s investors

Learn why traditional investments remain essential alongside alternatives for steady, long-term growth.

Alternative investments such as real estate, mortgages, and private equity play a valuable role in diversifying risk and have grown significantly in popularity for their stability and reliability. While these strategies add balance, the foundation of a strong portfolio still rests on traditional investments such as stocks, bonds, and preferred shares.

L-R: Portfolio Manager Apurva Parashar and Co-Chief Investment Officer Thomas Nowak

“While alternative investments are valuable, it’s important for investors not to lose sight of the benefits in traditional asset classes,” says Apurva Parashar, Portfolio Manager at Alitis Investment Counsel. “A comprehensive portfolio should include both, ensuring measurable growth alongside stability.”

Traditional building blocks such as stocks and bonds remain the backbone of wealth accumulation, while alternatives provide balance and consistency.

“A great example of this approach is the Alitis Income and Growth Pool,” says Thomas Nowak, Co-Chief Investment Officer at Alitis. “It offers our most diversified investment strategy with a balanced mix of traditional and alternative investments. This approach is designed to generate a moderate level of capital appreciation and income generation over the long-term.”

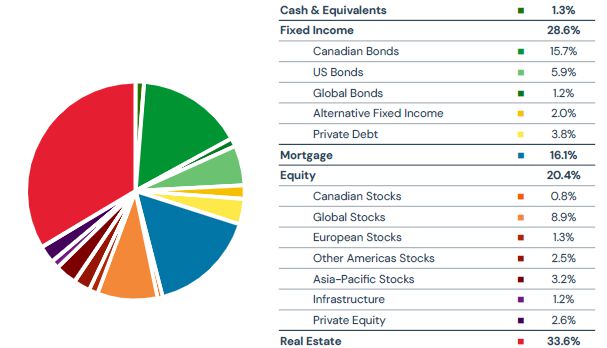

Asset Allocation of the Alitis Income and Growth Pool as of July 31, 2025

The benefits of this combined approach are clear when looking at recent results. As global equity benchmarks such as the S&P 500 and MSCI World Index experienced sharp dips earlier in 2025, the Alitis Income and Growth Pool stayed comparatively steady and continued climbing. As of July 31, 2025, Alitis’ diversified approach had delivered a positive 3.52% per cent return (Class D Units) – steady growth achieved with noticeably less volatility than the broader markets.

“Turbulent traditional markets combined with the stability of alternative markets is a reliable recipe for reducing risk and limiting the impact of downturns,” Nowak explains. “That’s why we encourage clients to take advantage of both.”

This lower-risk, diversified style of investing is gaining popularity, not only because it works, but because it offers predictability and reassurance.

“Now is a great time to revamp portfolios,” Nowak says. “By blending both traditional and alternative investments, investors can set themselves up for consistent growth and long-term security.”

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation: