How is the Alitis Income & Growth Pool managed?

The Alitis Income and Growth Pool is an amalgamation of the investment strategies and approaches used in the Alitis Strategic Income Pool, Alitis Private Mortgage Fund, Alitis Growth Pool, and Alitis Private REIT. The Income and Growth Pool does not invest in these other funds, but most of the underlying holdings are the same. The portfolio is split roughly into four, with each component fulfilling its role within a diversified portfolio:

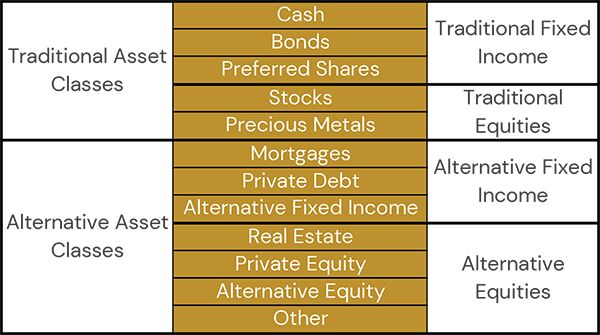

- Fixed Income – This portion of the Pool utilizes traditional bonds as well as private debt and alternative fixed income products in order to provide a moderate level of income. For more information on how fixed income investments are managed, please see the Alitis Strategic Income Pool. The fixed income portion of this Pool will be managed almost identically to how the Strategic Income Pool is managed.

- Mortgages – This component is allocated to various private and publicly-traded mortgage entities with the goal being to provide a high level of income in most investment conditions. For more information on how mortgage investments are managed, please see the Alitis Private Mortgage Fund. Please note, however, that direct mortgage investments are not used in the Income and Growth Pool.

- Equities – The equities portion of this Pool may invest in traditional stocks along with other alternative types of investment such as private equity, hedge funds, precious metals and other equity strategies in order to provide growth over the long term. For more information on how equity investments are managed, please see the Alitis Growth Pool. The equity portion of this Pool will be managed almost identically to how the Growth Pool is managed.

- Real Estate – This portion will be made up of various individual real estate projects along with various other real estate investments in order to provide growth and income for the Pool. For more information on how real estate investments are managed, please see the Alitis Private REIT.

At times the proportions may vary, particularly if the decision has been made to hold some monies in cash. The allocation to each component is determined by Alitis’ Investment Committee based upon the expected returns and risks for each.