Overview

The Alitis Strategic Income Pool is an income-oriented portfolio with a mix of traditional and alternative investments designed to generate a high level of income generation. The main features include:

- Incorporates all fixed income asset classes, except mortgages.

- Utilizes three different approaches to fixed income management.

- Provides income potential for your portfolio.

How could the Alitis Strategic Income Pool fit into your portfolio?

The Alitis Strategic Income Pool was created for individuals with a 2 year and longer time horizon. This pool also incorporates both traditional and alternate fixed income asset classes, improving its diversification and making it a great investment for those seeking income.

What type of asset classes does this fund use?

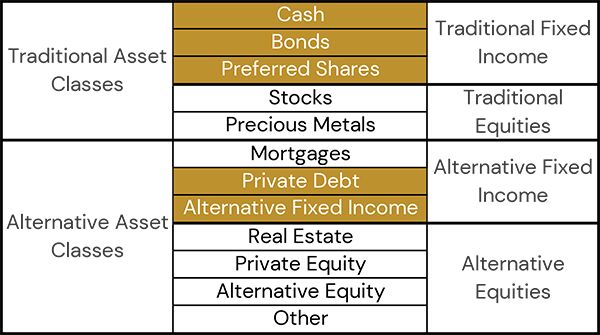

The Alitis Strategic Income Pool is permitted to invest in cash and most types of fixed income, as indicated below:

How is the Alitis Strategic Income Pool Managed?

Alitis selects each of the investments in the Pool as well as the allocation of these investments. On a broader level, the portfolio is split into three, with each component acting to complement the others:

- Component 1: Managed by Alitis – Alitis utilizes a top-down approach to allocate investment opportunities based on credit quality and duration (i.e. how long until the bond matures). The premise for this approach is threefold: (1) economic conditions can be volatile so the flexibility to shift between high quality (government), mid-quality (corporate) and low quality (high yield corporate) sectors is important, (2) inflation expectations change to the ability to shift between shorter-term bonds (better in rising inflation) and longer-term bonds (better in steady or reduced inflation) is necessary, and (3) situations that arise in the real world (e.g. Covid) can have a significant impact on the financial world, making the need to shift strategies quickly even more important.

- Component 2: External Managers – These managers are generally experts in their chosen areas and are left to invest as they see fit. Utilizing managers such as these provides a complement to Alitis’ top-down approach and addresses our primary risk management question, “What if we are wrong?” Having other managers who look at situations differently allow for portfolio risk to be better managed.

- Component 3: Alternative Fixed Income – The final component of the Pool is made up of alternative fixed income investments that tend to act differently than traditional ones – investments such as private debt and fixed income hedge funds. At different times, these investments have shown that they may enhance returns or reduce risk when added to a portfolio of traditional fixed income investments. In essence, this component complements the traditional fixed income investments used by Alitis and the external managers.

At times the proportions may vary, particularly if the decision has been made to hold some monies in cash if investment conditions appear unfavourable.