Why do people invest in real estate in Canada?

This is a question that has many different answers, and everyone has a different opinion on the topic. Personally, I invest in real estate because of the diversification, long-term stability, growth potential, and tangibility of the assets.

As we are in 2025, I thought it would be of interest to ask the updated magic eight ball “Chat GPT” what its response would be to the same question. The answer provided is as follows:

“People invest in real estate in Canada because it offers stable long-term returns through property appreciation and rental income, supported by strong population growth and high housing demand. The market is considered safe and transparent, with tax advantages and opportunities to leverage financing. Real estate also serves as a hedge against inflation and a reliable way to diversify investment portfolios.”

Artificial intelligence highlighted some strong points; however, given the current economic climate, there is understandable hesitation. At the moment, we are not seeing the expected growth in population, housing demand, or property appreciation. That said, this is a point-in-time issue. As the economy recovers, population growth is expected to rebound, and housing demand will inevitably rise once again.

In its June 2025 report, “Canada’s housing supply shortages: moving to a new framework¹”, the Canada Mortgage and Housing Corporation (CMHC) explores both current and future housing needs across the country. The report updates the supply gap estimates using enhanced models on a range of scenarios through to 2035. This provides us with detailed information on where additional housing supply is needed to restore affordability in Canada.

CMHC estimates that the Canadian population will reach nearly 45 million by 2035 compared to just over 41 million today. Housing starts must nearly double to around 430,000 to 480,000¹ units per year until 2035 to restore affordability and meet this projected demand. According to CMHC, Canada saw approximately 245,367² new housing units started in 2024. It is worth noting that CMHC’s population projection reflects data from Statistics Canada and includes policy changes to reduce immigration announced in 2024.

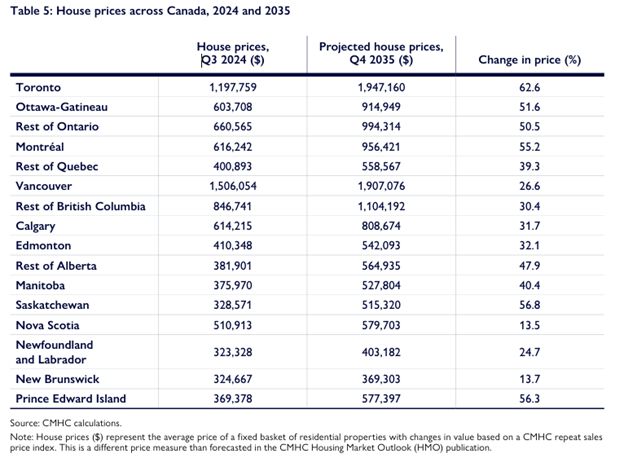

In a base case scenario, CMHC projects that is housing starts remaining steady at approximately 250,000 units per year through 2035, Canada’s housing stock will increase by 2.5 to 3 million units, reaching a total of 20 million units within Canada. These projections, which factor in population growth, housing supply, and economic conditions, help outline a potential trajectory for home prices and average incomes—key elements that together shape housing affordability. The table below¹ shows that house prices will continue to increase, resulting in further deterioration in affordability, if there is no action to increase supply beyond current levels. Additionally, without additional supply, CMHC expects average rents to increase by about 40%¹, from around $1,400 today to over $1,900 by 2035.

As a real estate investor, this is encouraging news. While we are currently experiencing a stabilization in rental rates and rising vacancy rates nationwide, CMHC’s report¹ suggests this is a short-term situation. The underlying demand for housing remains strong, highlighting solid long-term fundamentals for continued investment growth.

This brought me to my next question for our new AI Oracle. What are the barriers to investing in real estate in Canada?

“Barriers to investing in real estate in Canada include high property prices, especially in major cities like Toronto and Vancouver, which require large down payments. Strict mortgage lending rules and rising interest rates can make financing difficult. Investors also face high transaction costs, such as land transfer taxes, legal fees, and closing costs. In some provinces, rent control regulations can limit income growth. Government policies, including foreign buyer restrictions and vacancy taxes, may further deter investment. Lastly, managing property can be time-consuming and complex, especially for those without local experience.”

I couldn’t agree more. While real estate investing may appear straightforward, it often comes with significant costs and time commitments. That’s why a solution like the Alitis Private REIT is so valuable – it provides investors with exposure to real estate without the challenges of direct ownership. REITs offer professional management and diversification across multiple property types and sectors (e.g., residential, commercial, industrial). REITs also typically require less capital than purchasing property outright and offer a convenient, regulated, and transparent way to participate in real estate markets.

Ready to explore the benefits of real estate investing without the hassle of direct ownership? Contact our team today to learn how the Alitis Private REIT can fit into your investment strategy.

Sincerely,

Ryan Patterson, BComm.

Senior Real Estate Strategist

Alitis Investment Counsel

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation:

Disclaimers and Disclosures

The information presented in this article includes content generated by ChatGPT, an AI language model developed by OpenAI. The views expressed by ChatGPT do not necessarily reflect the views of Alitis and should not be considered personalized financial advice or an endorsement of any specific investment strategy.

Source: ¹CMHC – Housing Market Information, June 2025, “Canada’s housing supply shortages: moving to a new framework”. ²Government of Canada Statistics – Canada Mortgage and Housing Corporation, housing starts, under construction and completions, all areas, annual (table 34-10-0126-01, release 2025-01-17).