Key Highlights from Canada’s 2025 Federal Budget for Investors and Retirees

On November 4, 2025, Canada’s Minister of Finance unveiled a federal budget¹ that marks a significant shift in fiscal policy. This budget was the first budget released since Mark Carney became our Prime Minister and the shift in approach compared to our previous Prime Minister is evident.

The government aims to respond to persistent economic challenges, tariffs from our neighbours to the south, slower growth, affordability pressures, and demographic changes—while planning to restore confidence in Canada’s long-term financial stability.

The budget has two key themes of reducing operating spending and increasing investment in capital investments.

Reducing Operating Spending

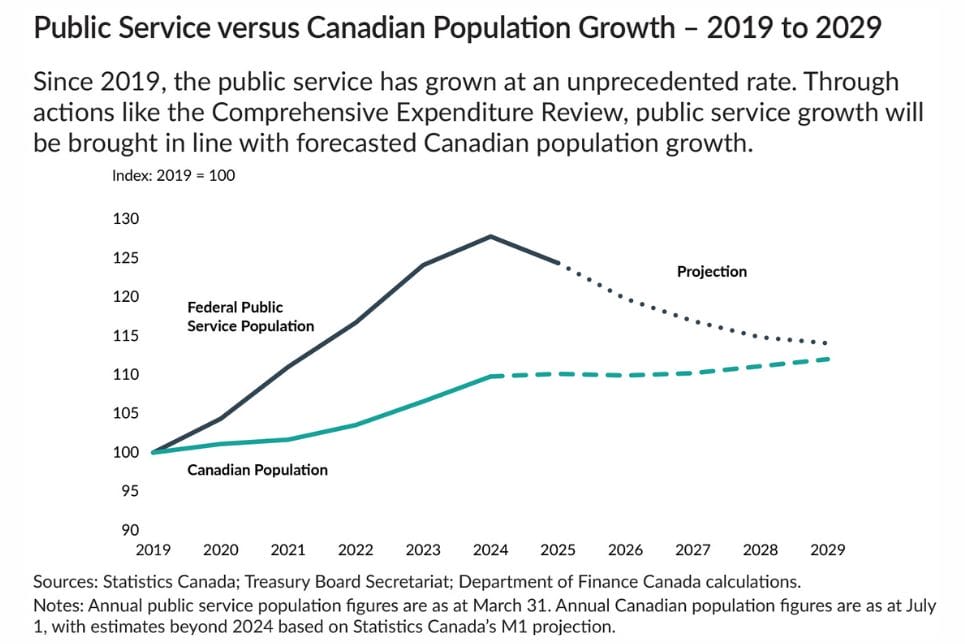

The federal public service saw a significant growth in the number of public service employees from 2019-2024. This budget aims to reduce the number of employees working for the federal government to more sustainable levels over the next four years:

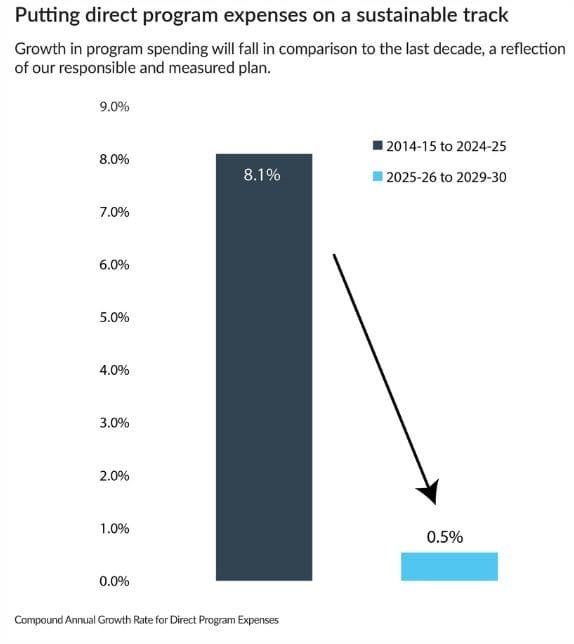

The government also aims to keep government programs sustainable by reducing the annual growth rates. From 2015 to 2025 government programs saw compounded annual growth rates in expenses of 8.1%. This budget proposes reducing that to 0.5% over the next five years.

Capital Investment

The budget focuses on building the resilience of our country as we face new global challenges by allocating more to capital investments. It highlighted the need to fast track nation-building projects, trade diversification, housing investments, and increased defense spending.

The investments include the following over the next five years:

- $25B on Housing

- $30B on Defense and Security

- $115B on Infrastructure

- $110B on Productivity and Competitiveness Initiatives

Highlights That Matter To You

While the highlights above are important to be aware of, many Canadians will want to know how it impacts them directly. This budget contained a few minor changes, but nothing that is expected to be controversial – you may recall some controversy around the capital gains, inclusion rate changes from a few years ago, that were quickly cancelled by the new leader.

Here are a few of the highlights:

Personal Income Tax Adjustments

- Lowest Federal Tax Rate Reduced: The first bracket drops from 15% to 14%, effective July 1, 2025 (blended 14.5% for 2025). Note that this was previously announced in the Spring and implemented on July 1, 2025.

- Top-Up Tax Credit: Maintains the value of non-refundable credits through 2030 to account for the change in the tax rate adjustments noted above.

Housing Incentives

- GST eliminated on eligible new homes up to $1M for first-time buyers; partial relief up to $1.5M.

Stability for Retirees

- No changes to RRIF minimums.

- Capital gains inclusion rate remains at 50%.

Other Measures

- Underused Housing Tax eliminated.

- Changes to the Home Accessibility Tax Credit to prevent taxpayers from deducting the same expense twice.

- Amendment to the tax act to allow CRA the authority to file a tax return automatically for lower-income Canadians to ensure they qualify for eligible benefits.

What This Means For You

Given this budget’s focus on reducing operating spending and increasing capital expenditures, most Canadians won’t see an immediate, material impact on their pocketbooks as a result of the changes.

The government’s strategy focuses on making Canada more resilient for the long term to tackle the affordability crisis, diversify our trading partners, increase productivity, and support growth.

Only time will tell if these measures succeed in achieving their intended outcomes.

Our team remains committed to providing timely updates on matters that could affect you, your portfolio, or your family’s financial well-being. If you have any questions about this update or your portfolio, please connect with your portfolio manager.

Our Team at Alitis

Our dedicated team at Alitis has over 250 years of collective industry experience. But what makes us unique is the high level of integrity that every team member brings to the table.

Along with experience and integrity, each team member at Alitis shares the same commitment to our clients. At the end of the day, we measure our success based on the success of you reaching your financial goals.

If you’re interested in investing with Alitis, let’s have a conversation:

Disclaimers and Disclosures

- Canada, Department of Finance. “Canada Strong: Budget 2025.” Our Plan: Building Canada Strong | Budget 2025, Government of Canada, 4 Nov. 2025, budget.canada.ca/2025/report-rapport/intro-en.html.