Overview

The Alitis Private Mortgage Fund is a diversified portfolio of alternative investments with a focus on private residential and commercial mortgages. This Fund is designed to generate a high level of income with relatively low volatility.

How could this fund fit into your portfolio?

This fund was created for investors with a 4 year and longer time horizon looking to access a broad range of private and public mortgage investments. Not limited to a single mortgage investment corporation (MIC), a single strategy, a single region or a single manager makes this fund attractive to those seeking to add a well-diversified mortgage solution to their portfolios.

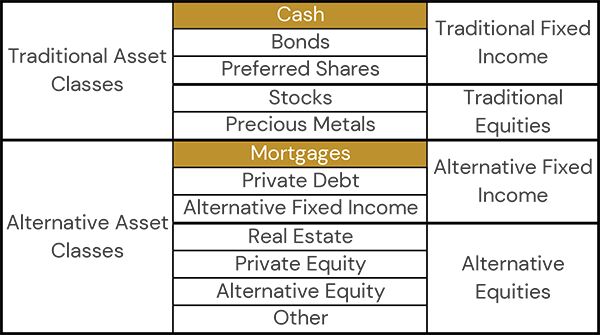

What Asset Classes Does This Fund Use?

How is the Alitis Private Mortgage Fund managed?

The Alitis Private Mortgage Fund investment strategy combines three different approaches to mortgage investing into one package:

- Private Mortgage Investment Entities – We start with a core of institutional and best-in-class private mortgage offerings to create a diversified foundation to mitigate risks.

- Publicly-Traded Mortgage Investments – We strive to enhance returns by trading in public mortgage securities when their valuation is favourable compared to private mortgages. Public securities also provide further liquidity for the fund.

- Direct Mortgages – We invest directly into specific mortgages to customize exposure, manage risk and enhance returns.