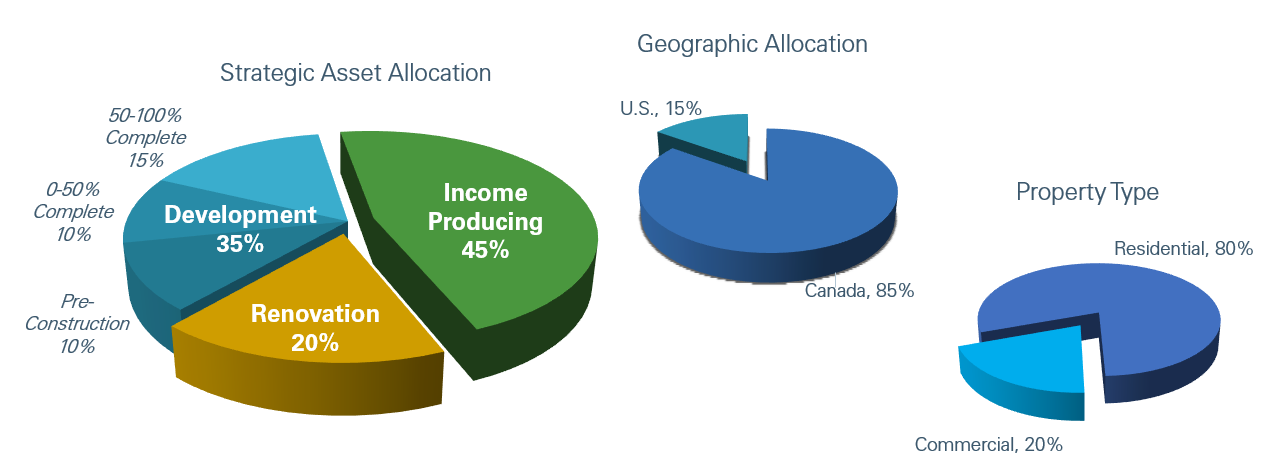

The Alitis Private REIT offers access to high-quality private real estate in one well-diversified solution and is designed and managed differently from other private and public REITs in Canada. In order to maximize risk-adjusted returns through various real estate market cycles, we specifically use three strategies – Income Producing, Renovation and Development – that contribute to income and capital appreciation. The investment objective of the Alitis Private REIT is to generate a moderate level of income and tax-efficient capital appreciation over the long-term.