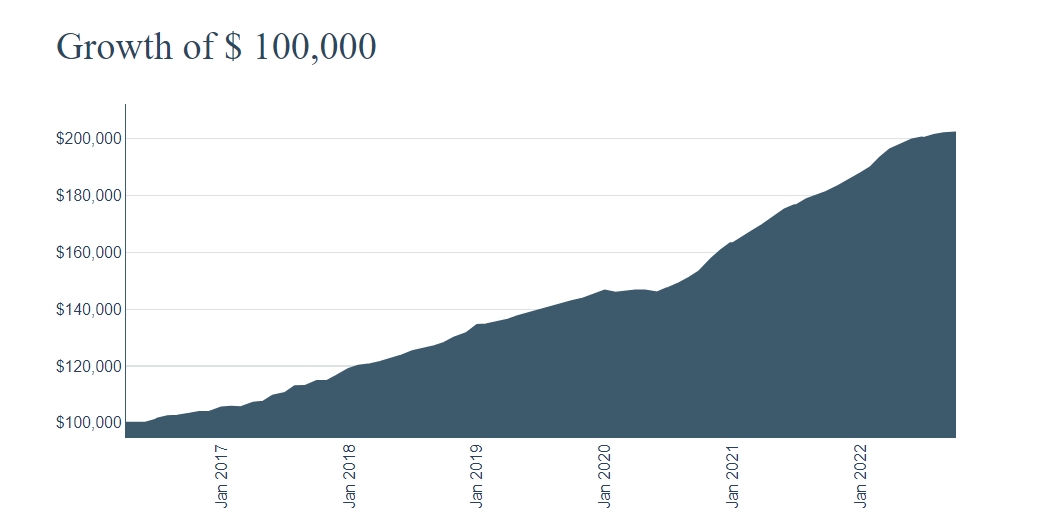

Canadians have been investing in real estate for many years. One difficulty for many investors is finding a financial adviser that offers a REIT that can provide some sense of stability with the growth they desire. In our opinion, the Alitis Private REIT is designed and managed differently from other private and public REITs in Canada. Our portfolio managers developed and manage the REIT to maximize risk-adjusted returns.

If you are an investor looking for a REIT with a track record of growth and an advisor that understands real estate and investment planning, contact Alitis today.