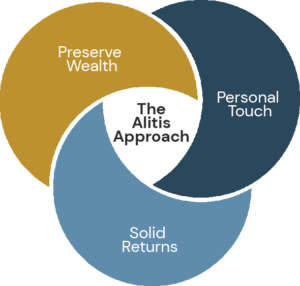

Our approach to investing is driven by what we are trying to do for our clients – “Provide everyday investors access to financial opportunities typically reserved for the ultra-wealthy.” These financial opportunities are what allow the ultra-wealthy to worry much less about their financial situation through the ups and downs of the markets. So, what is it that the ultra-wealthy want when it comes to investments? From our experience, it comes down to three main things, and this is the investment approach taken by Alitis:

1. Preserve Wealth

The preservation of wealth is paramount. As such, risk management is a critical aspect of what the ultra-wealthy look for when investing as a way to minimize losses. Alitis approaches investing in the same way – risk management comes first.

- Use more asset classes

- Everyone has access to traditional stocks and bonds, but the ultra-wealthy have access to alternative investments that usually require a lot of money to get into. These alternative asset classes allow for much greater diversification within an investment portfolio, which is usually the easiest way to lower risk. At Alitis, we utilize many alternative asset classes – such as real estate, mortgages, private debt, private equity, and others – to diversify portfolios to better preserve wealth.

- Use multiple managers

- Alitis is not an expert in all types of investments. That is why we partner with other investment managers whose specialized expertise complements our investment approaches. This multi-manager approach provides increased diversification across different asset classes, geographies and styles.

Preserving wealth starts with asking the question, “What happens if I am wrong?” The ultra-wealthy spend a good deal of time addressing this question and often use the simple approaches above. These options are not always available to regular investors, however, but Alitis has created accessible investment products that utilize these techniques.

2. Earn Solid Returns

Getting your money to work for you is the second aspect that the ultra-wealthy desire. They want their investments to earn solid returns so their wealth can grow and not be eroded by the ravaging effects of inflation. This does not mean searching for that one investment that will make massive returns. Rather, the ultra-wealthy want reasonable, steady returns which allow them to achieve their other desire of preserving wealth. Alitis approaches this desire in a similar manner – solid and more predictable returns are better as they allow for better planning for the future. Some of the techniques we use to earn solid returns include:

- More asset classes and multiple managers.

- The same concepts used to preserve wealth also provide a mechanism to earn solid returns. The use of alternative asset classes often allows for higher returns because they are not as accessible at the traditional stocks and bonds and do not have their prices bid up to unreasonable levels. And using multiple managers with different approaches within each asset class helps make the returns achieved less volatile and more predictable.

- Tactical shifts and rebalancing.

- The techniques are not exclusive to the ultra-wealthy. However, when they are applied to an investment portfolio with many more asset classes, like those of the ultra-wealthy, the ability to generate higher returns is amplified as there are more assets classes to shift into, making this process a place where much more value can be created than a traditional stock and bond portfolio. Similarly, rebalancing allows for returns to potentially be enhanced simply by selling high and buying low in order to get back to a target allocation – a process that is enhanced by utilizing far more asset classes.

Earning solid returns works hand-in-hand with preserving wealth as many of the same concepts apply to both. The ultra-wealthy know this and their wealth enables them to change the rules by adding those extra asset classes and managers which can enhance returns, along with performing portfolio maintenance activities but on a broader scale. All of this is designed to allow for the steady accumulation of wealth.

3. A Personal Touch

The ultra-wealthy understand that getting expert investment advice is vital to achieve their goals of preserving wealth and earning solid returns. They understand that a trusted advisor who understands their requirements will be better able to help them. For regular investors, you often do not get the personal touch or get to deal with the same person on an ongoing basis. These days, many financial institutions have a revolving door of advisors or simply try and push you towards their online robo-advisors. That is not the personal touch you need. At Alitis, you work with an adviser who gets to know you and your needs, and will work with you to create an investment portfolio that works for you – one that contains all those extra asset classes usually reserved for the ultra-wealthy.

Pooling Resources

How does Alitis enable regular investors to access investment opportunities usually reserved for the ultra-wealthy? We simply combine the resources of many investors into seven investment pools so that each of these pools has the assets of an ultra-wealthy person. With this larger pool of money, Alitis invests into this broader range of investments, such as real estate, mortgages, private equity, private debt, and hedge funds. When combined with traditional asset classes, a very diversified portfolio similar to those of the ultra-wealthy is created. As well, you can have confidence in knowing that your advisor is backed by a large supporting team. Come meet them now.

Our Team

LEARN MORE

Retirement Planning

LEARN MORE