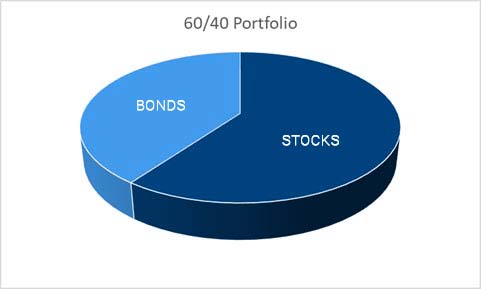

As portfolios are migrating from low-yielding fixed income investments to publicly-traded stocks, the higher valuations for stocks cause investors and investment managers serious concern.

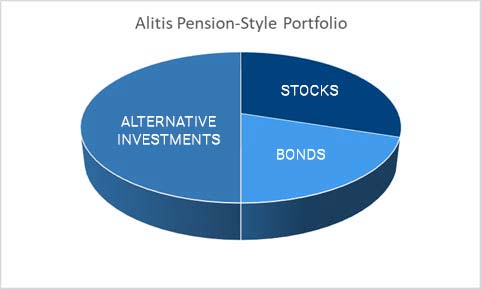

We believe that success in this New Paradigm requires innovation that challenges conventional investments we were previously comfortable with. For retail investors, this is a New Paradigm. But the fact is that including Alternative Investments is not new at all. It’s been used for decades by institutional investors and wealthy families. These astute investors have altered their asset mix to include meaningful allocations to Alternative Investments to reduce risk and deliver total return.

We start with a small base of stocks and bonds and then carefully add a chosen mix of alternative investments, with a focus on diversification and downside protection. These alternative investments can diversify risks, significantly dampen portfolio volatility, and offer the potential for higher returns over the long term.