Constructing Pension Style Investment Portfolios

A Strategic Approach with Alternative Asset Classes

Constructing robust investment portfolios that can deliver consistent returns while mitigating risks is of great importance. Traditional pension-style investment portfolios have historically leaned heavily on stocks and bonds. An investment approach gaining increased attention is the incorporation of alternative asset classes into investment portfolios in the pursuit of added diversification and enhanced returns. Pension funds, endowment funds, ultra-high-net-worth families, and advanced investment firms are actively including alternative investments in their portfolios as a strategy to improve risk-adjusted returns.

The Evolution of Pension-Style Portfolios

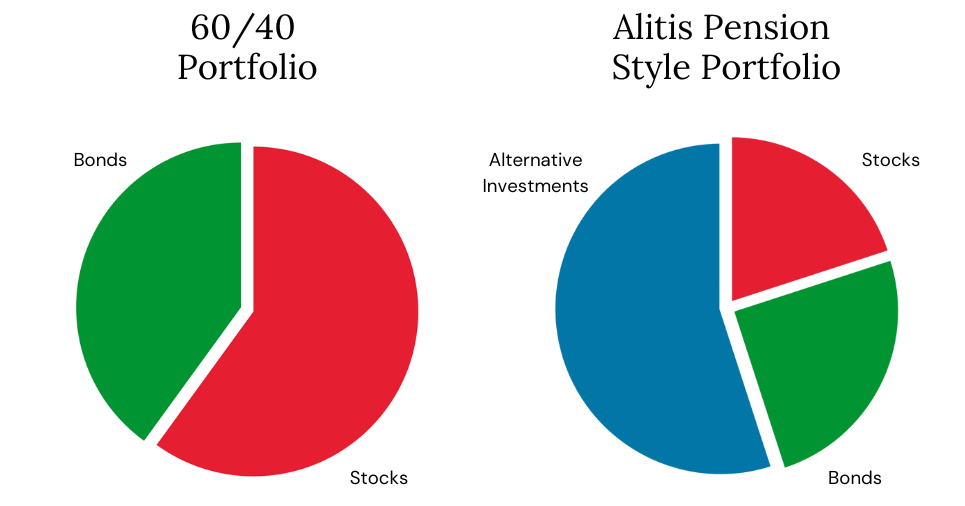

Pension-style investment portfolios have long been the backbone of institutional investing. These portfolios are typically characterized by a long-term investment horizon, designed to generate stable returns to fund future liabilities, such as retirement benefits. Traditionally, these portfolios relied heavily on a combination of stocks and fixed-income securities, notably bonds. The 60/40 portfolio, which consisted of 60% stocks and 40% bonds, was a popular choice for pension funds. This allocation was considered a balanced approach to achieve long-term growth while managing risk. While these assets continue to play a crucial role in a portfolio’s construction, the investment landscape has evolved, offering a broader range of investment opportunities, and portfolio managers are increasingly seeking alternative asset classes to enhance diversification and returns.

The Case for Alternative Investments

Alternative asset classes encompass a wide range of investments that extend beyond traditional stocks and bonds. These assets include private real estate, private mortgages, private equity, hedge funds, commodities, infrastructure, and more. The inclusion of alternative investments can offer several advantages to pension-style investment portfolios.

- Diversification: Alternative asset classes tend to have low correlations with traditional investments like stocks and bonds. This means that when traditional markets experience downturns, alternative assets may provide a hedge, potentially reducing portfolio volatility.

- Enhanced Returns: Some alternative investments, such as private equity, have historically delivered attractive returns over the long term. These assets can complement traditional holdings and boost overall portfolio performance.

- Inflation & Interest Rate Protection: Traditional fixed-income investments can be sensitive to interest rate changes. Real assets like real estate and commodities have the potential to act as a hedge and offer insulation against inflation and rising interest rates, which is a critical concern for long-term investors like pension funds.

- Risk Management: Alternative assets often employ unique strategies that can help manage downside risk, adding an element of stability to a portfolio.

Constructing Pension-Style Portfolios with Alternative Assets

Emulating institutional portfolios using alternative investments presents the challenge of achieving solid returns with lower volatility while providing reasonable liquidity for life events and ongoing lifestyle needs.

A common misconception among many individual investors is the belief that their entire portfolio needs daily liquidity when, in many cases, this is not the reality. In truth, most investors typically require a combination of income, growth, and access to some of their capital for various planned and unplanned purposes. The majority of an individual’s portfolio is typically held for the long term, only partially utilized during retirement, with the remainder passed down to the next generation or donated for philanthropic purposes. For many investors, their investment portfolio is intended to be a long-term asset.

Conclusion

Alitis’ multi-strategy, multi-manager, and multi-investment approach is an excellent way for individual investors to gain access to alternative investments. Long-term returns have been solid for these categories, and the liquidity and entry barrier that has prevented most Canadians from gaining access is dramatically reduced with our approach.

In our view, the traditional 60/40 portfolio model for private clients is the past. Alitis has worked intelligently to replace it with the new investment paradigm approach that includes meaningful allocations to a diverse pool of alternative investments. The operative words here are diverse (diversification for safety with lowered correlation) and meaningful (a large enough allocation to make a difference).

Alitis offers a suite of investment products that are designed to provide investors with access to a broad range of asset classes and investment styles in order to generate solid returns with a lower level of risk. We use our investments both individually and in combination, to construct our client portfolios.

Contact Us Today

Schedule a no-obligation, complimentary meeting with a Portfolio Manager today. Find Alitis Investment Counsel in Campbell River at 101-909 Island Highway, in the Comox Valley at 103-695 Aspen Rd., in Victoria at 1480 Fort St., and online at alitis.ca. For more information, call 250-287-4933 or email info@alitis.ca.