How to build your wealth like the ultra-wealthy

When you are searching for the best way to do things, you look for someone with experience. If you need information on gardening, you go to a nursery. If you want to build a house, you find a professional homebuilder with a good reputation and a long track record. Many people would say the same applies to investing: if you want to find the best strategy for building wealth, you look to those who have accumulated the biggest portfolios over the years. Enter the “Ultra-High Net Worth Individual” (UHNWI).

According to Investopedia, UHNWIs are those with investable assets of at least $30 million, an amount that many people balk at. UHNWIs are people too. As my mom would say, “They put their pants on one leg at a time like the rest of us”. They can have biases and make mistakes. However, here are three techniques in which they excel that everyone can use to invest like the ultrawealthy.

Lesson 1: Use a Team Approach

UHNWIs often have complicated financial pictures, and it is important that all the moving pieces fit together. Many UHNWIs will establish their own family office to manage their affairs with a team consisting of accountants, financial planners, portfolio managers, lawyers, and other professionals. The main pillars of planning include complex topics such as investments, insurance, tax planning, estate planning, and generational wealth transfers.

While it is unrealistic for most people to personally retain such an assembly of individuals, these are all professionals that everyone can and should gain some access to. Think of your financial life as a company. If you have multiple departments doing the same thing, you can reduce redundancies. If there are departments missing entirely, the best time to complete your team is now. If you are wanting to build a strategy to maximize your wealth and meet your objectives, you will be better off with input from a team of experts with diverse backgrounds.

After all, if these different professionals are not working towards the same goal there could be issues. For example, your portfolio manager could earn you an excellent return, but if they are not aware of a plan you made with your accountant to provide a large cash gift to one of your children, then it may be in an illiquid asset that is difficult to gift.

By having a level of coordination between these professionals, you can have a unified plan that covers all your bases and minimizes confusion. The most important part of using a team of professionals is not to make your life as complex as a UHNWI but to streamline your resources so you can spend less time worrying about your life’s journey and more time enjoying it.

What can a team of professionals do for you?

If you think of the group of professionals in your team as the company supporting your financial and life goals, each should bring value to you and provide a return on investment toward achieving your goals. In the organizational structure, each also brings a unique skill set.

Lesson 2: Invest in Alternative Asset Classes

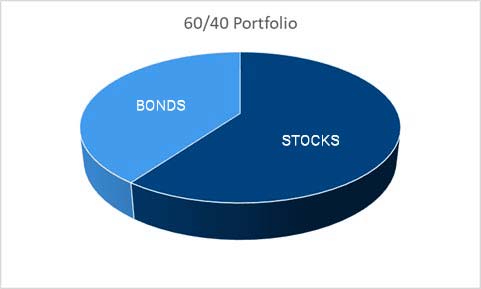

Picking any single asset class to invest all your money is quite literally putting all of your “nest eggs” in one basket. There is a chance it may work out, but it is a precarious move that is unnecessary for building your net worth over time.

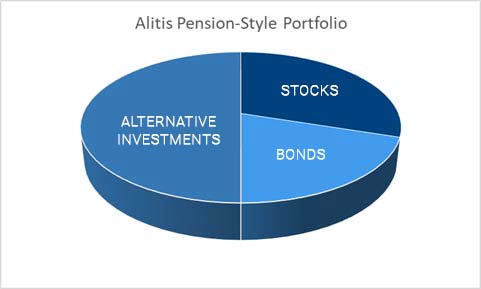

Increased diversification leads to better risk-adjusted returns. An important tool in the UHNWI toolkit for diversification is alternative asset classes. This includes access to private markets like private mortgages, private real estate and private debt.

What are the benefits of having access to private markets? For your portfolio, it means having investments that are less correlated to public markets so you will see less volatility during market turbulence. In addition, many of these asset classes have higher expected returns because they earn an illiquidity premium, which is the additional compensation used to encourage investments in assets that cannot be easily or quickly converted into cash at fair market value.1

Private markets are not without risk. The key risk is that you cannot sell these investments quickly so it should not be where you invest your “in case of emergency” money. Another risk is that high minimum investments, which are common to alternative asset classes may lead you into concentration risk. This means that you cannot buy enough variety in your investments to diversify your portfolio properly. For UHNWIs that have portfolios in the tens of millions of dollars to invest, this is rarely an issue.

At Alitis, we use pooled investment vehicles so that all our clients can gain an appropriate allocation to alternative asset classes allowing them to meet their return objectives with their given comfort level of risk.

Lesson 3: Take A Long-Term View

If you are completely focused on the short term, you will find this slows your progress.

Last week I went mountain biking for the first time in a while with some friends. Given I was a little rusty and was riding a borrowed bike, I was a little slow to get going. I could not help focusing on every single root and obstacle in my way and found myself off-balance and falling behind.

Soon enough, one of my friends noticed what was going on and gave me some advice. She told me to stop looking down and start looking ahead. When you are moving faster and keeping your vision forward, the bike will absorb those bumps along the way, and you will have greater control. Sure enough, with this bit of advice, I was able to hit the trails with greater speed, keep up with the group and have a lot more fun!

With investing, there are also times when the short-term bumps are taking up too much of our attention. UHNWIs are very good at keeping their attention on long-term goals. One reason for this is they often have a portion of their wealth in low-risk investments that are enough to meet not only emergencies but also to sustain their lifestyle over the long term.

This is important because it gives them the comfort and control needed in case of a market downturn, which is the exact point in time where they SHOULD NOT be making changes to their portfolios. After all, if a portfolio is truly built to fit your needs, it should be a good fit across all parts of the market cycle.

It is important for everyone to have money accessible for emergencies, as there is no telling what the future will hold. While few people can allocate enough to sustain their lifestyles for decades like a UHNWI can, a good guideline many financial planners would say, is to have enough to cover typical expenses for six months.

This does not necessarily mean that your emergency money needs to be sitting in a bank account earning nothing, but it is something to think about. If your current income were interrupted for the next six months, where would you access cash in a way that does not incur excess taxes or fees? If you can answer this question, you will find yourself well on your way to thinking long-term.

Summary

There is no “one size fits all” financial plan or secret investing plan for the ultrawealthy. Everyone will have different opportunities, goals and constraints along their financial journey.

By thinking like an Ultra-High Net Worth Individual, you can:

- Build Your Team to make a unified plan to maximize your wealth

- Gain access to Alternative Asset Classes to diversify your portfolio

- Take A Long-Term View to prepare for and minimize obstacles along the way

Growing your wealth is similar to managing your personal health. Different techniques and routines will work for different people. There are many aspects to consider and you must continue to monitor and work on it regularly if you expect it to improve.

If you would like to discuss and discover ways to grow your wealth like an Ultra-High Net Worth Individual, please reach out to us to schedule an appointment with one of our Portfolio Managers.

Sincerely,

Thomas Nowak, CFA

Portfolio Manager

Disclaimers and Disclosures

- Porter, TJ. “Liquidity Premium: Definition, Examples, and Risk.” Investopedia, Investopedia, www.investopedia.com/terms/l/liquiditypremium.asp. Accessed 3 June 2024.